Orchestrate cashflow and pricing

Orb has the tools you need to help accounting run seamlessly and take control of your growth strategy.

Trusted by

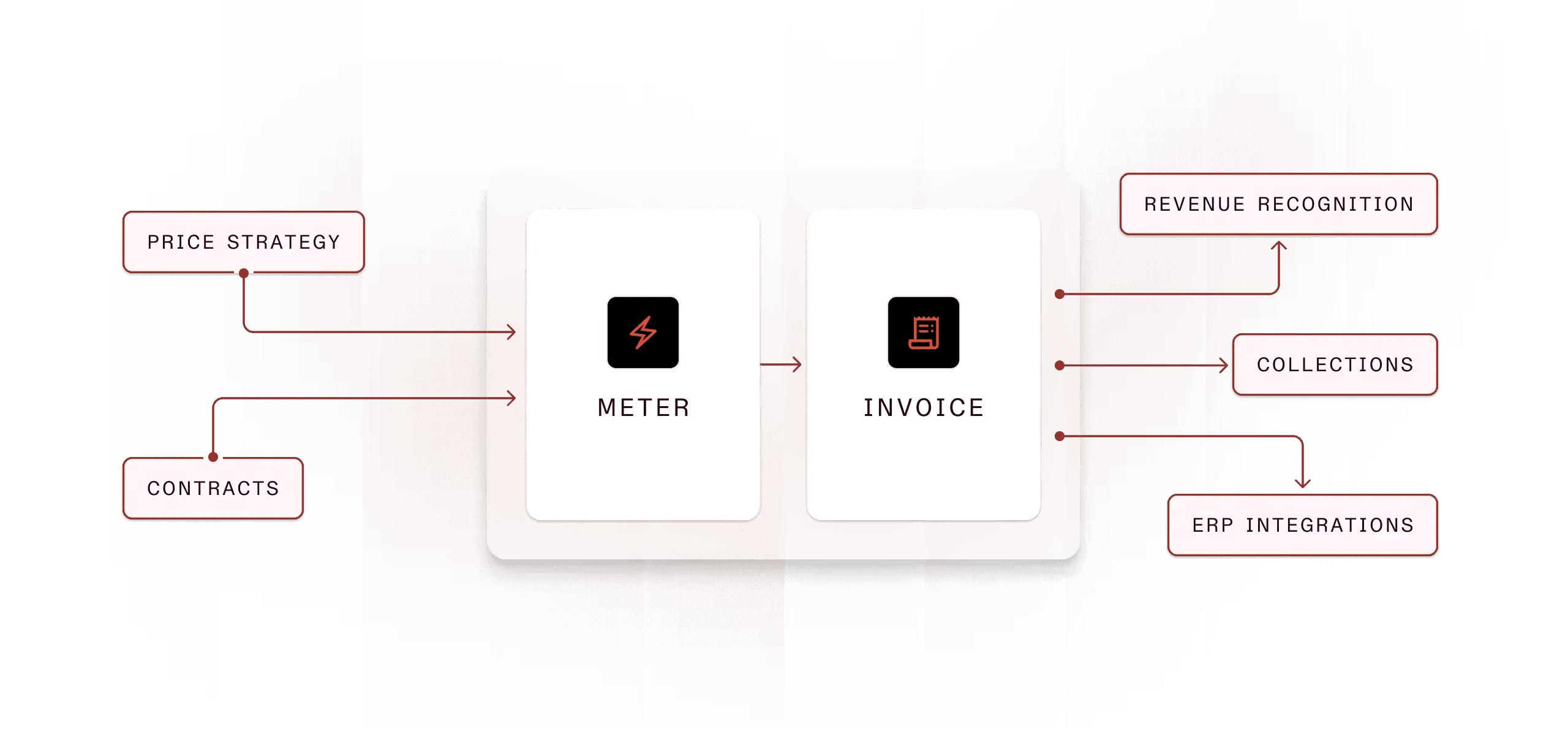

For billing and beyond

From strategy to recognized revenue, Orb is built with the full finance workflow in mind.

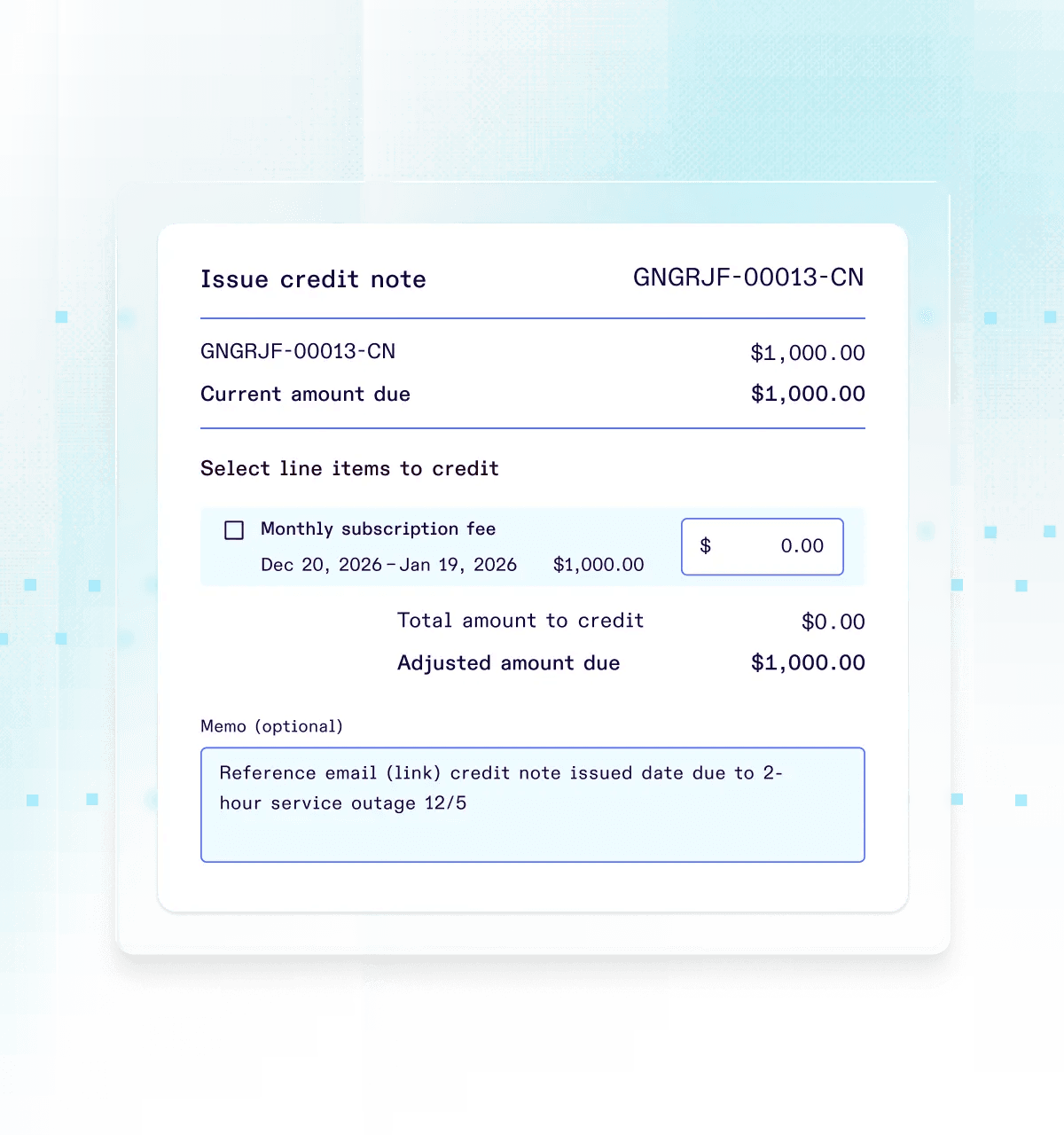

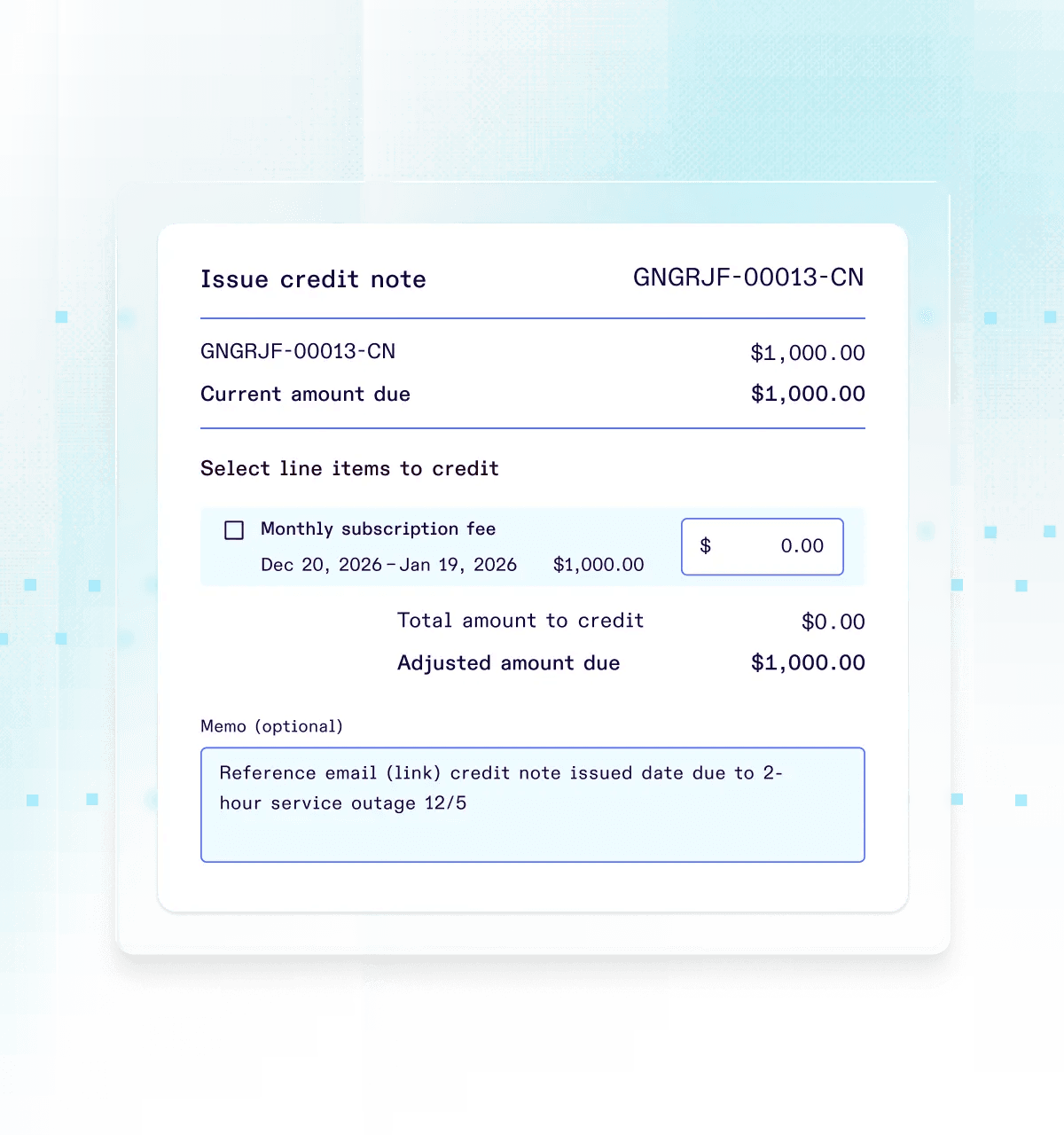

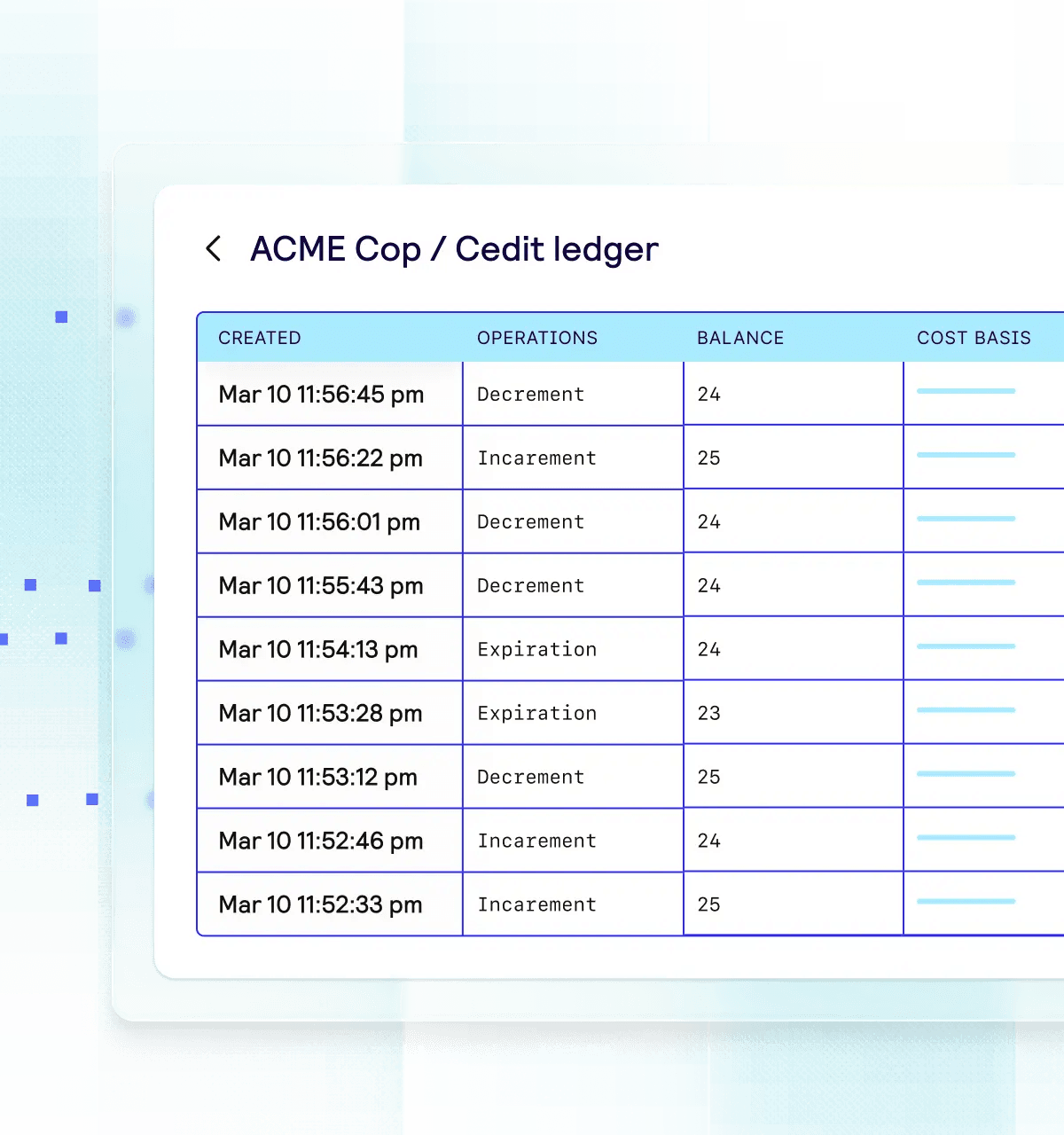

Audit-ready foundations

Maintain confidence through chaos

Orb maintains product and revenue data history to leave a documented trail of decisions and impacts to save your team headaches.

- Document business logic with descriptors for price changes and adjustments and contract references in invoice memos

- Reconcile across systems with exportable daily summaries and integrations to ERP, accounting and CRM platforms

- Mitigate risks with version-controlled price changes that can be staged or rolled back.

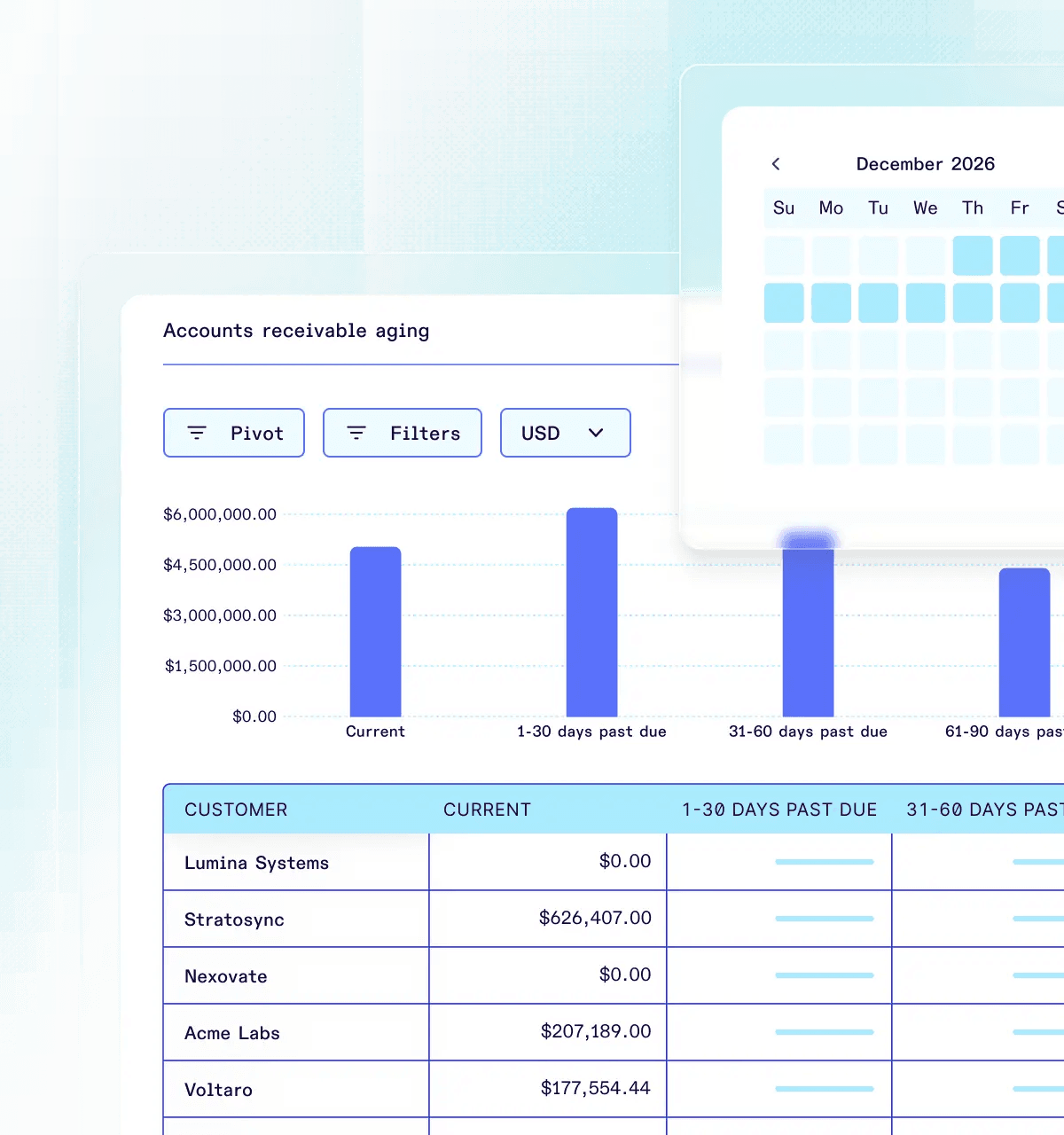

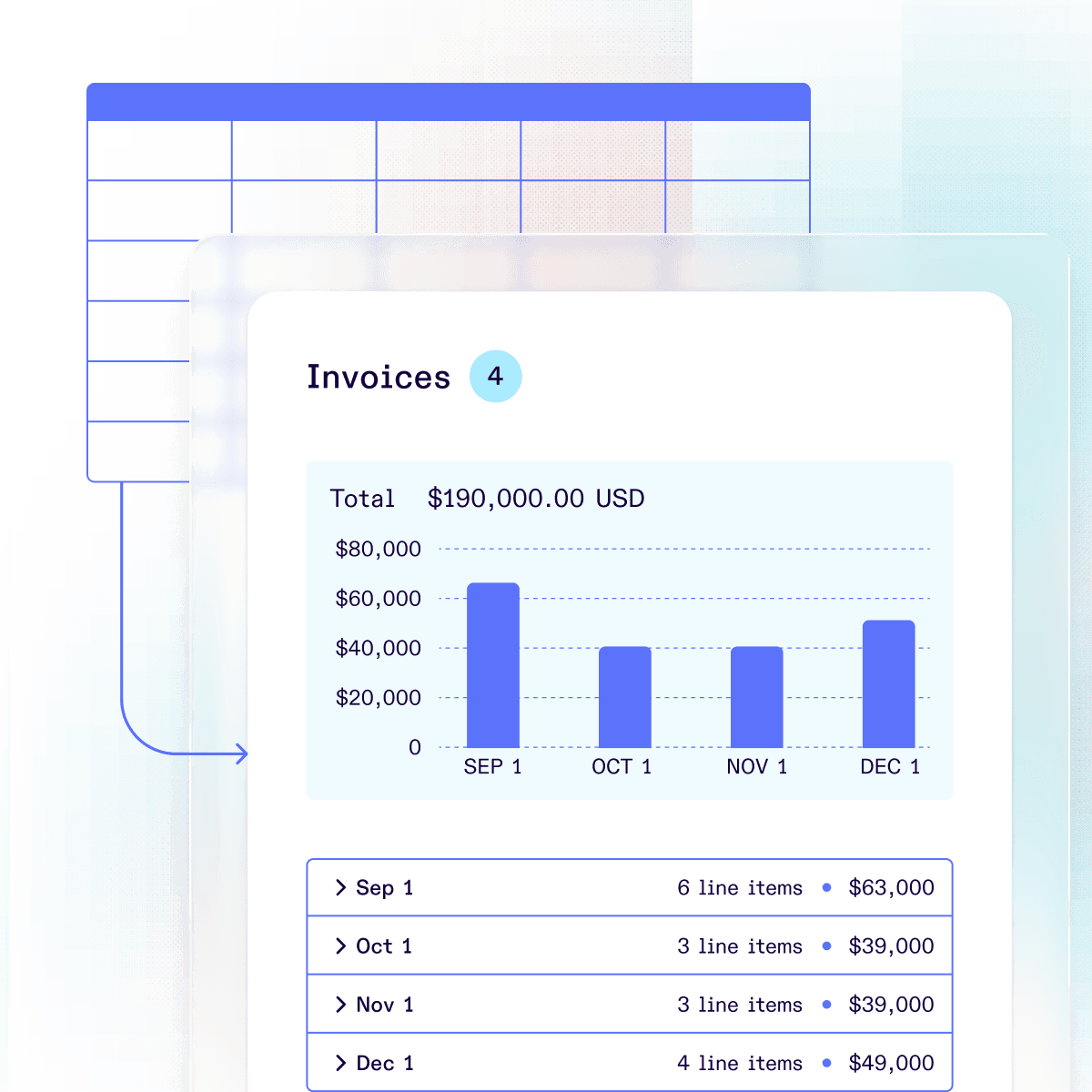

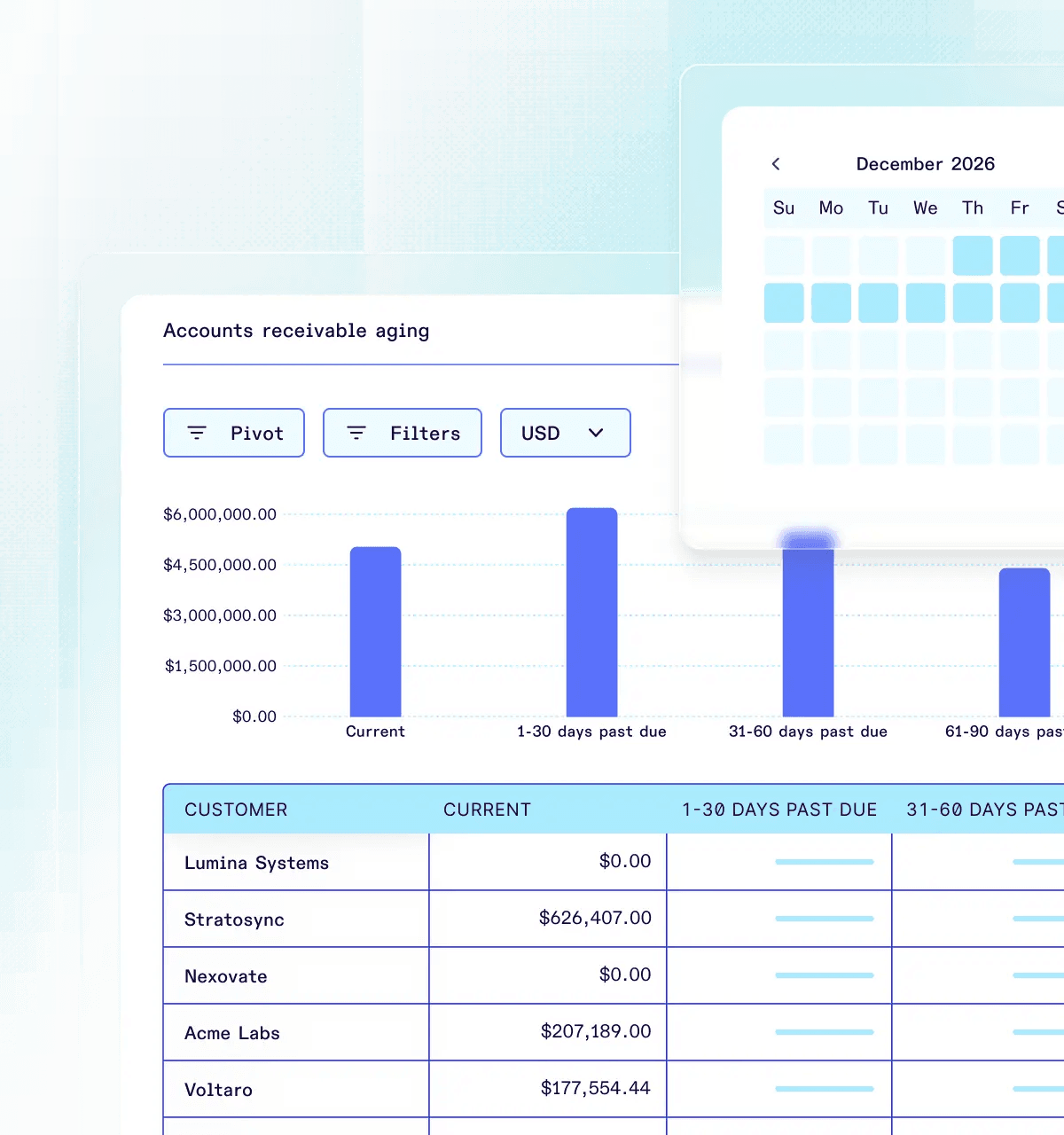

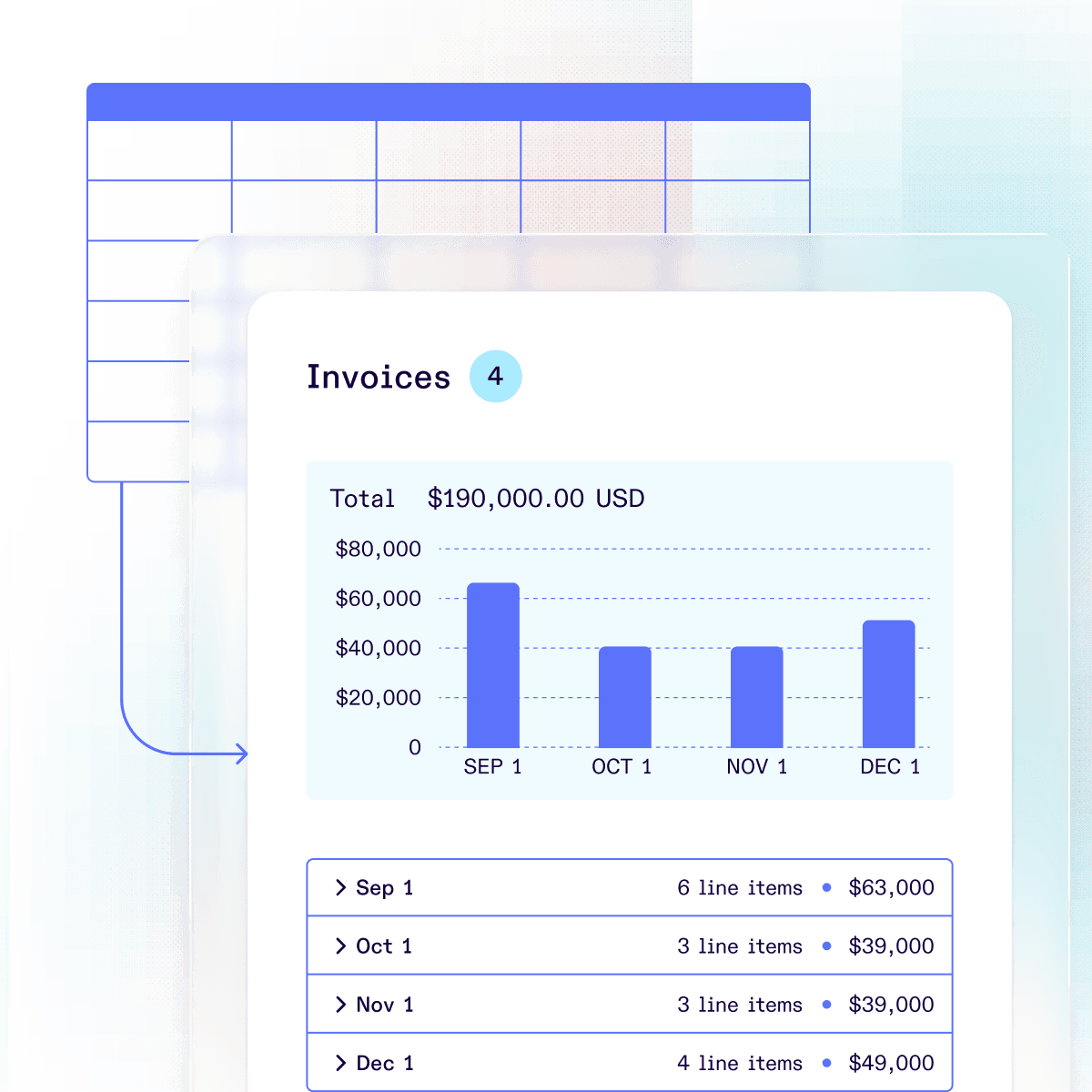

Collections and RevRec

Keep the cash flowing

Orb connects your post-invoice workflows to your source of truth to deliver up to date, centralized information about revenue.

- Revenue recognition: ASC606-aligned reporting built for the complexity of usage-based billing

- AR aging reports: Understand cash flow and identify overdue invoices

- Advanced dunning: customize dunning rules to retry payments, send emails and recover revenue from overdue invoices or failed payments

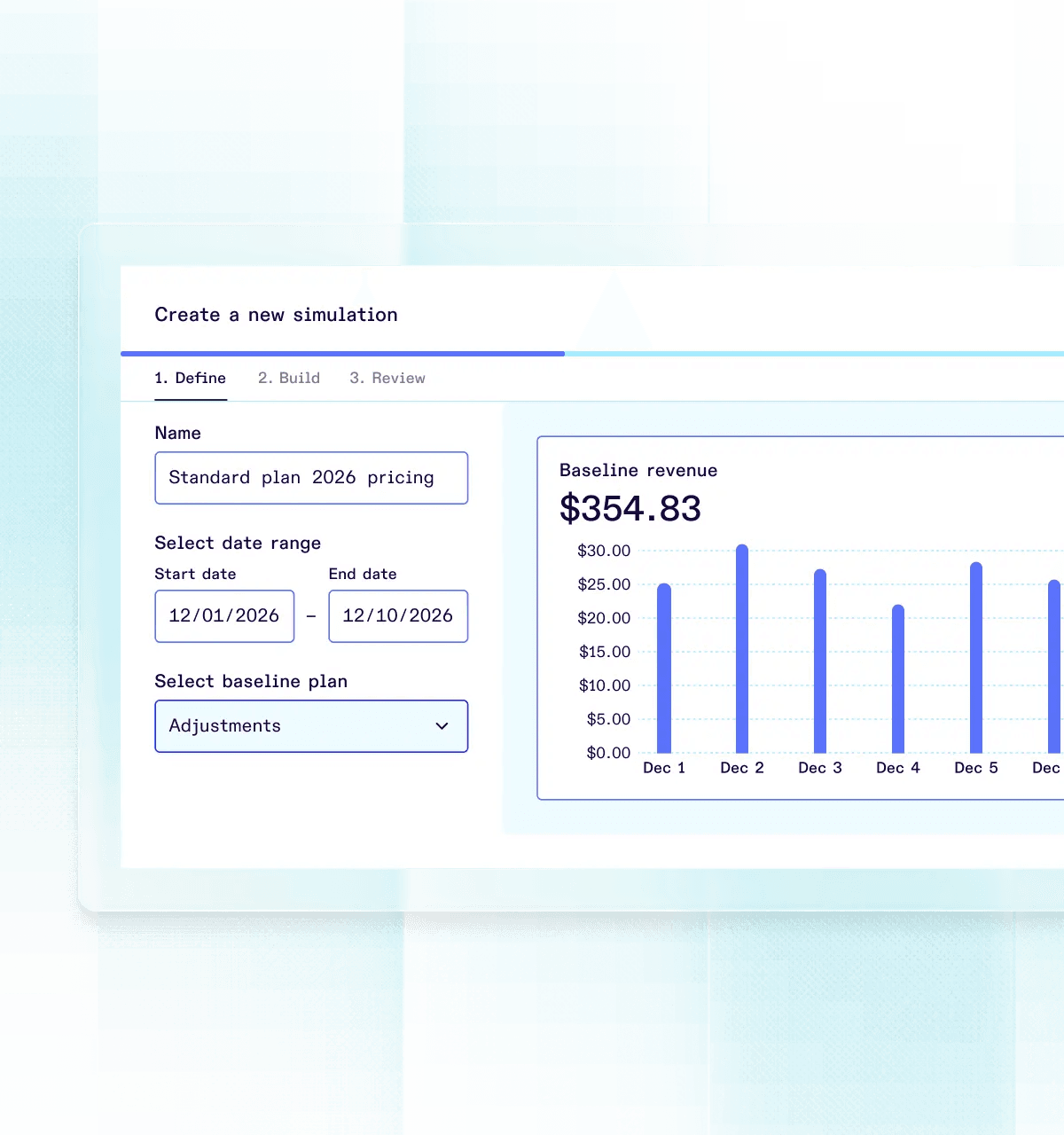

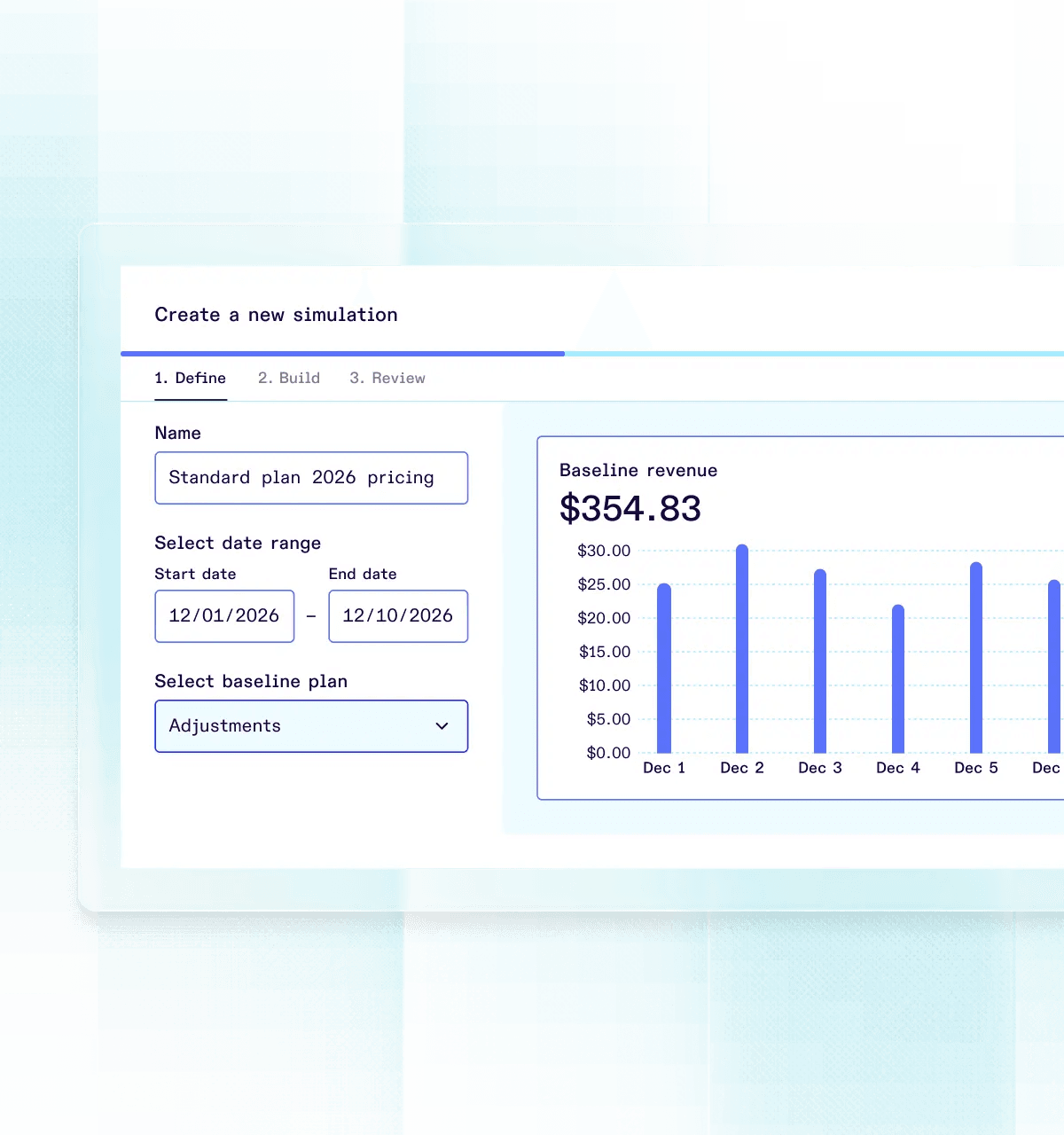

Price Strategy

Price for growth without engineering limitations

Orb puts finance at the helm to ensure that your team implements price models and contracts that drive profit.

- Set global strategy: Define prices in a central, accessible pricebook

- Simulate new price models: Ensure that new prices and product launches are defensible by data

- Enterprise contracts: Templatize complex discount structures and model pricing to give your team more levers to win

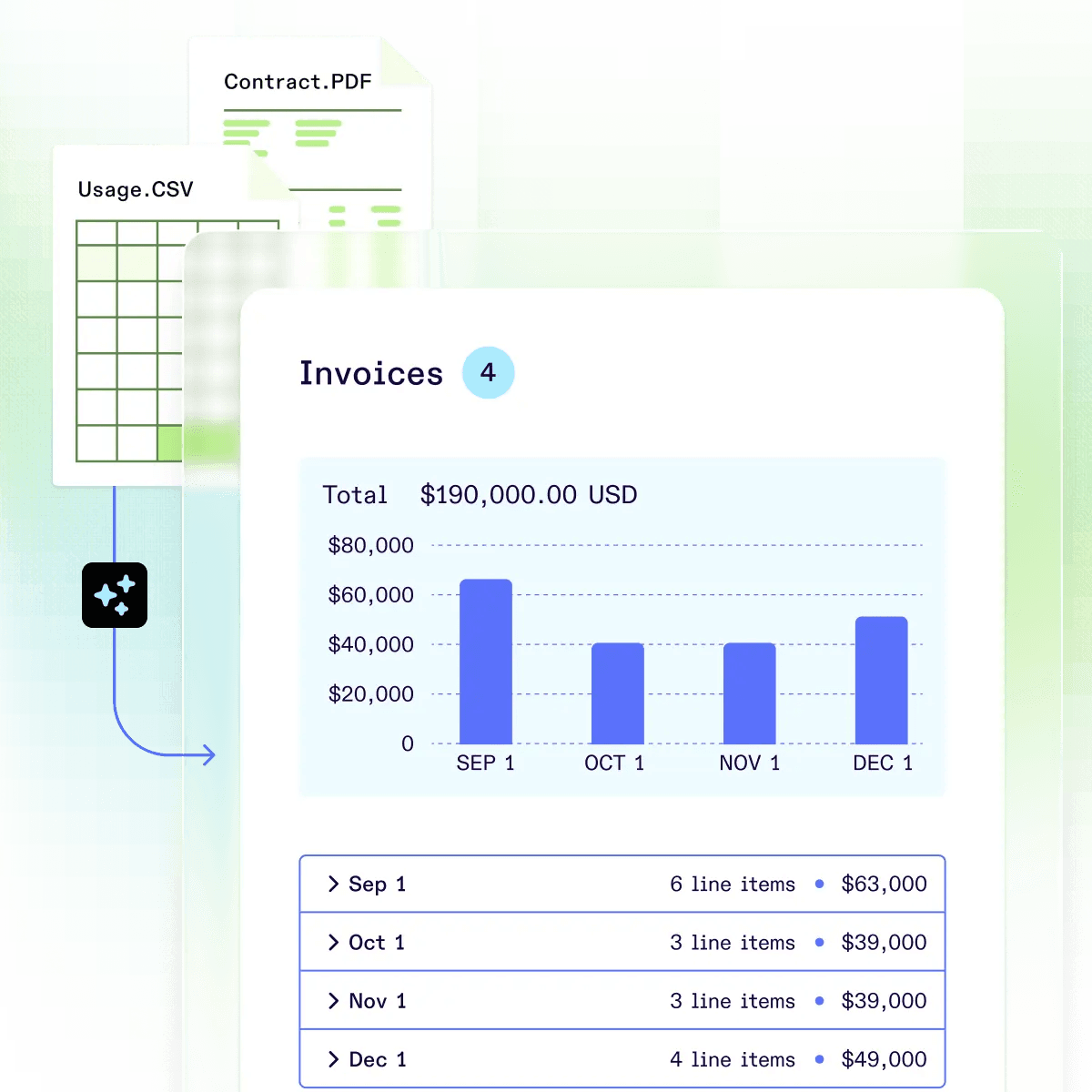

Contract to cash

Enterprise scale, without the complexity

Whether you’re an enterprise organization that needs to move quickly, or a growing company moving upmarket, Orb gives finance teams the tools to:

- Parse contracts with AI to save time and reduce errors

- Upload usage by CSV to start billing engineering-free

- Create plans to organize customers

Integrations

Your finance stack’s best citizen

Orb is designed to work alongside the tools that keep your organization running.

CRMs

Bi-directional integrations that map contracts into Orb, and populate fields in Salesforce with billing and usage data to track account health where your reps work.

Tax systems & ERPs

Sync invoices, credit notes, and payment records to tools like Netsuite to align with your existing workflows.

Invoicing solutions

Send invoices natively from Orb, or integrate with the systems supporting your seat-based business.

“Your accounts receivable module couldn't have come at a better time, to be honest. It's a godsend just because there's nothing else that is closer to our invoices and our status right now than Orb itself... I've been using it already for a couple of days and it's going to be the blueprint of our chasing efforts.”

Tiger Data

Hybrid businesses

Product agility, scaled brilliantly

New AI products are major revenue opportunities, but can also cause significant disruptions to systems built for subscription monetization. Orb helps with:

- Seat and hybrid pricing thats maps your business model

- Usage-native revenue recognition that simplifies end of month close

- Security and compliance tools that help control risk

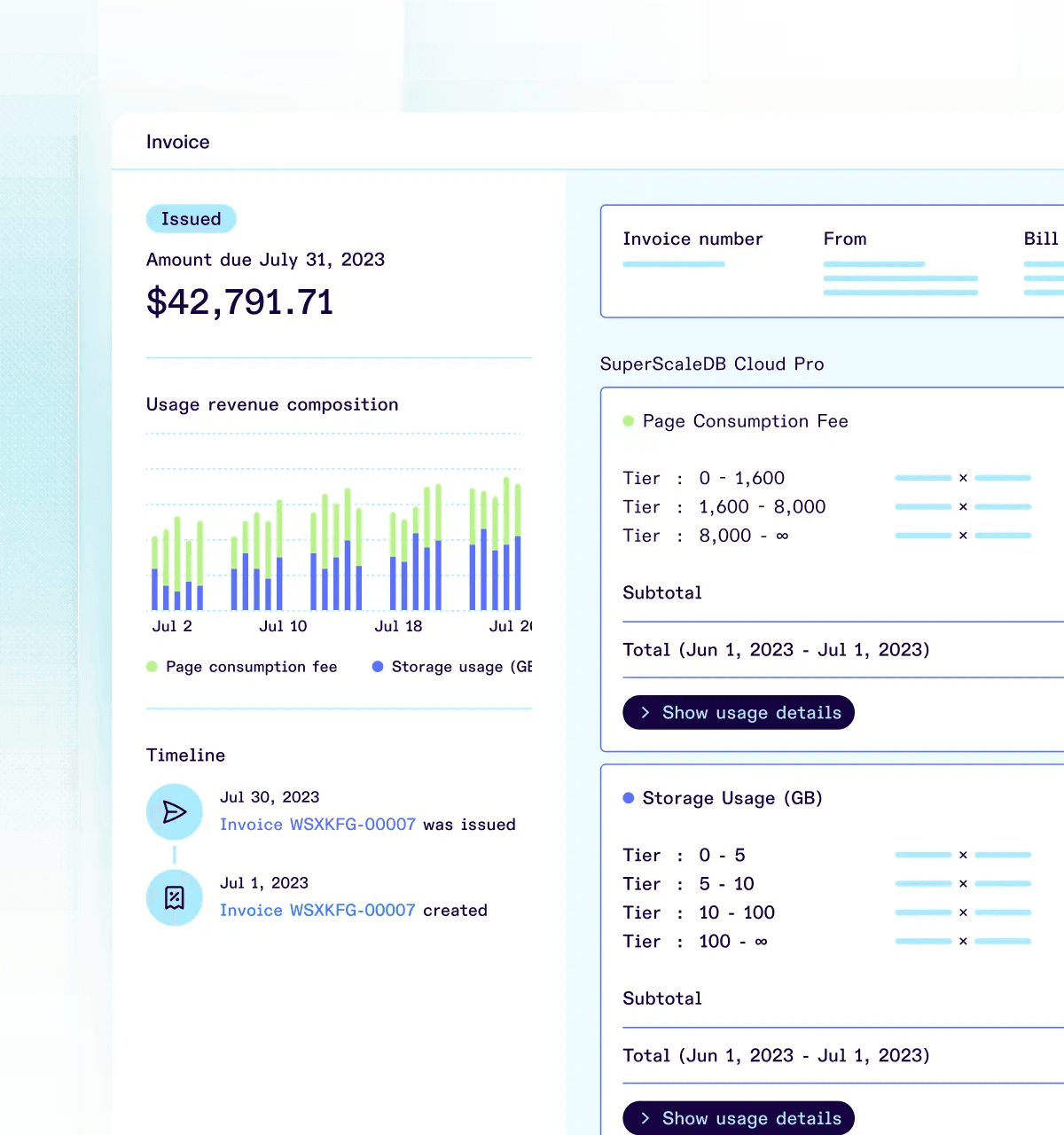

AI monetization

Fine-grained controls at the speed of innovation

AI monetization models demand special consideration for revenue recognition and audit readiness. Orb helps finance teams stay on top of complexity with:

- Scoped credits help maintain granular control over how prepaid balances are consumed

- Immutable credit ledger supports audit-readiness for complex custom credit structures

- Contract commits support more predictable ARR to simplify forecasting

Sales-led growth

Finance tools built for growth

Large-scale contracts demand maximum flexibility. Orb helps finance teams adapt to critical deals.

- Simplify contract to cash with AI contract parsers and CSV uploads

- Model custom contracts with intuitive adjustments

- Backdate price changes as renewals and renegotiations evolve

Ready to try a billing platform built for modern growth?

See how AI companies are removing the friction from invoicing, billing and revenue.